Overview

Calculation of taxes on reservation folios and masters in RDP have undergone various changes over the years. This is the current way taxes are calculated in RDPWin and IRM.Net. These two products share the same base code, so any changes to one will effect the other. There are three distinct types of transactions:- Rate Plan Transactions (Folio Only)

- General Transactions (Folio and Masters)

- Other Charges 3-7 Transactions (Folio Only)

There are also two basic methods for tax calculation:

- Tax Category - Preferred

- Transaction (Tables PK, C7 & BV)

These transaction types and tax calculation methods fit together as follows:

| Tax Category Allowed | Transaction Allowed | |

| Rate Plan Transactions | Yes | No |

| General Transactions | Yes | Yes |

| Other Charge Transactions | Yes | Yes |

Rate Plan Transactions

There are two possible components to a rate plan transaction. One is the rate set (room portion) and the other are optional components that can be added to make a package. Both the rate set and the component definition require a tax category. The older method of defining the tax percent with the C7 and PK tables is no longer supported for rate plan transactions.

General Transactions

General Transactions are those that are manually posted to a folio or a master. These transactions are defined in the Accounting section of RDPWin using Add Transaction Code. The tax category is optional in these definitions in order to support the legacy method of Tables PK and C7. The preferred method of tax calculation is by Tax Category.

Other Charge 3-7 Transactions

Other Charges (configurable

by property) are a special case of a general transaction, because they can be

defined to use a rate plan component to look up the price of the charge.

General transactions have the price optionally set as part of the transaction

definition. For Other Charges, the system looks to the transaction

definition and not the rate component definition to determine the tax

calculation method. As such, both tax calculation methods are allowed.

If the tax category method is used on the Other Charge

transaction, then only Table C7 is needed to look up the taxes. However,

if the tax category method is not used and there are tax components on the

transaction, then Table BV needs to be updated for the different tax codes (TA,

TB, TZ) to complete the tax calculation.

Tax Category

There are two benefits with this tax calculation method. First, it is

much easier to manage because it is more general than placing the tax

percentages on each transaction definition. Second, it supports up to four

taxes, each with an assigned general ledger account. Although up to four

taxes are calculated, they are bundled to two fields on the reservation and

folio transactions. Tax 1 and tax 2 at the tax category level are added

together and put into the tax 1 on the reservation/folio. Tax 3 and tax 4

at the tax category level are placed in Tax 2 on the reservation/folio.

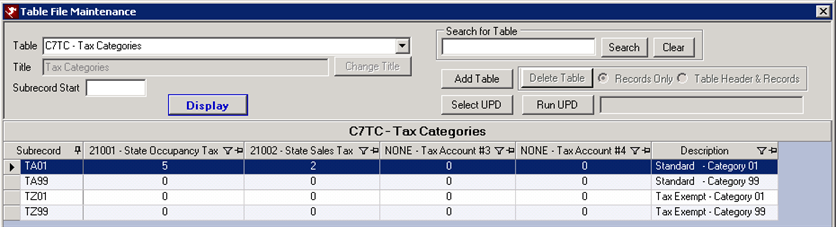

Tax categories sub-divide the tax code assigned to a reservation or master.

These are defined in Table C7, where the sub-record is the tax code and tax

category. For instance, TA02 would be the taxes for tax code TA and tax

Category 02.

The table below shows an example of tax codes and tax categories. In

this case, the rate set can be assigned tax Category 01, which includes bed tax,

while the components and other transactions can use the "General Tax"

Category 02 without bed tax. If there are some transactions that should never have

tax, then tax category 99 should be assigned to those transactions. Notice

that the TZ tax code assigns zero tax percent to all tax categories.

| Tax Code | Tax Category | Tax-1% (City) | Tax-2% (State) | Tax-3% (County) | Tax-4% (Bed Tax) |

|---|---|---|---|---|---|

| TA - Eagle County | 01 - Room Tax | 2 | 3 | 1.5 | 5 |

| 02 - General Tax | 2 | 3 | 1.5 | 0 | |

| 03 - State Tax | 0 | 3 | 0 | 0 | |

| 99 - No Tax | 0 | 0 | 0 | 0 | |

| TB - Summit County | 01 - Room Tax | 2 | 3 | 3.5 | 5 |

| 02 - General Tax | 2 | 3 | 3.5 | 0 | |

| 02 - State Tax | 0 | 3 | 0 | 0 | |

| 99 - No Tax | 0 | 0 | 0 | 0 | |

| TZ - Tax Exempt | 01 - Room Tax | 0 | 0 | 0 | 0 |

| 02 - General Tax | 0 | 0 | 0 | 0 | |

| 02 - State Tax | 0 | 0 | 0 | 0 | |

| 99 - No Tax | 0 | 0 | 0 | 0 |

Transaction (Tables PK, C7 & BV)

The transaction tax calculation method is invoked on the transaction

definition screen. Specify the tax category as "None - Use Tax Below" and

add tax components at the bottom of the screen. Bucket 7 is Tax 1 on the

reservation and transaction and bucket 8 is Tax 2 on the reservation and

transaction. Only two tax totals can be broken out

on the folio with this method. However, multiple Tax 1 or Tax 2 records

can be added with different general ledger accounts. The taxes defined as part of the transaction

are stored in Table PK.

Tables C7 and BV are used for two reasons. First and most common, is to

turn off the tax calculation. If the tax code in Table C7 and BV have a

zero tax amount for tax 1 or tax 2, then those taxes will always be zero

regardless of the taxes on the transaction. Tax code TZ is an example of

this. Also, C7 and BV can be used to override the taxes defined on the

transaction with a different amount set in those tables. There is an

"Override B2 tax only" field in these tables for this purpose. Note that

table C7 defines taxes for Room, Other Charge 1 and Other Charge 2 while table

BV contains the taxes for Other Charges 3 through 7.

Tax Code Defaults

The default tax code for short term reservations is TA. If there is a

tax code on the room master, then the default is changed to the tax code on the

room when it is assigned to the reservation. If there is a tax code on the

group master, then that tax code is use and overrides both the default and the

room master tax code.

For long term reservations, the default tax code is user defined along with

the number of days that define the long term reservation itself. See Long

Term tab on the Reservation configuration screen. Long term reservations

ignore the tax code on the room master.

Changing Tax Code on a Reservation

For future reservations, the tax amount on all transactions is recalculated. For in-house and checked-out reservations, none of the existing transactions are changed. Any transaction added after the tax code change use the new rate.

GST/PST Canadian Tax Information

Special Handling of Hawaii Tax for Owners

Configuration

Use Table Maintenance in the System menu to update the C7, C7TC, and BV tables with the appropriate tax percentages for the tax categories in use. Each tax code should have all the tax categories. Tax categories on the specific transactions are assigned in the Accounting | Transactions | Change screen.

For IRM.Net, a default tax code can be assigned on the Reservations tab in the System->IRM.Net Configuration screen.

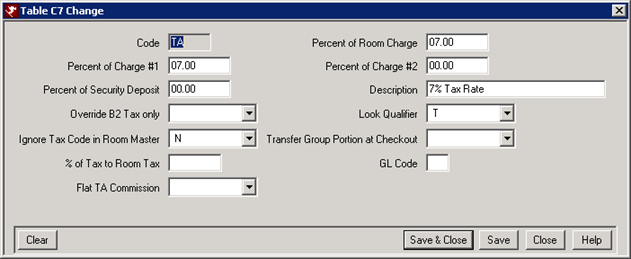

The C7 Tax table includes the total amount of tax for the room charge, charge 1, charge 2, and security deposit. Enter the total tax percentage for the TA record and any other tax records (tax records start with the letter 'T') from the C7 table.

The C7TC Tax Categories table includes the breakdown amounts for each by GL Account. There are four tax categories for each tax. The C7TC grid displays the GL Accounts for each tax in the column header. Double click on the tax record listed in the grid to change the tax amounts. The GL Accounts for Tax 1 - 4 are listed in the grid and if a tax does not have a GL Account assigned, it will display as NONE. The tax GL Accounts can be changed from the Accounting menu --> GL Accounts --> Change Offset Accounts.

Switches:

- C1LTTAX - Number of days that defines a long term reservation and uses the long term tax code

- C1TAXDEFa - Default when adding new room masters

- C1TAXDEFb - Default when adding new group masters

- C1HAWAII - Turns on the Hawaii tax feature

- C1GST1 - GST tax from reservation is passed to the Owner

- C1GST2 - Yes = GST is Tax 2. No = GST is Tax 1.