- Condominium Owner Account Module R3 required.

| Owner Configuration Tabs | ||

|---|---|---|

| General | Statements | Interest & Late Fee Tab |

| Taxes | Res Related Charges | Masters - Timeshare Configuration |

Overview

If any configuration settings are directly connected to a system switch,

that switch number is displayed on the Configuration screen. Configuration

for masters is divided into the following Tabs:

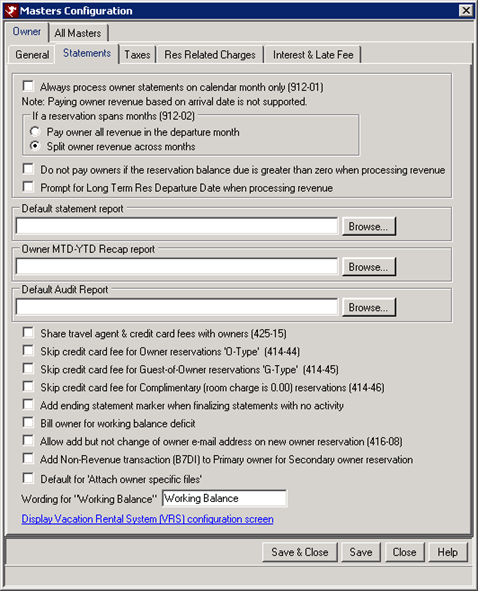

Statements

- Always Process Owner Statements on Calendar Month Only (912-01)

- Indicate how often owners are paid. When checked, the owners are

paid once and only once a month, and the system processes folio transactions

with a transaction date in the prior month. For example, if the

current date is 2/15/2005, the system processes folio transactions dated

prior to 1/31/2005. This switch is checked for most customers, since they

are processing January owner statements in February. Check this switch

to process owner statements monthly. This setting should not be

altered unless there has been a policy change regarding the time period

for paying owners.

When not checked, owners are paid more than once a month, and the system processes all folio transaction through the current system date. For example, if the current date is 2/15/2005, the system processes folio transactions with a date of 2/15/2005 and earlier. Leave this switch unchecked to generate owner statements on a non-monthly basis.

Note: Long term reservations are always processed monthly. Owner revenue is prorated per month. - If a Reservation Spans Months (912-02)

- There are two options for this switch: "Pay owner all

revenue in the departure month" and "Split owner revenue across

months".

- Split Owner Revenue Across Months.

When paying owners on a calendar month basis (Switch 912-1 is YES) and a reservation spans two or more months, reservation revenue is prorated across the months.

Note: RDP strongly recommends all customers prorate revenue across months to keep transaction dates from changing. - Pay Owner All Revenue in the Departure Month.

When paying owners on a calendar month basis (Switch 912-1 is YES) and a reservation spans two or more months, reservation revenue is paid in the month of departure.

- Split Owner Revenue Across Months.

- Note:

Paying revenue to owners based on reservation arrival date is not supported.

RDP does not

support paying all reservation revenue in the arrival month, as this makes

it impossible to close a statement. For example, if you have a reservation

from 2/25/06 to 4/10/06, checked out occurs 4/10/06 at which time the

statement for February (the arrival month) would have already been closed.

- Do Not Pay Owners If Res Balance Due is Greater Than Zero When Processing Revenue

- When checked and owner revenue is processed, gross owner revenue for

reservations with a current balance due greater than zero (as of the system

date, not the process date) is skipped. This only applies to the

balance due field on the reservation. Revenue can

be manually marked for processing regardless of reservation balance within

the Process Owner Revenue process.

Important: This feature should not be used by properties that transfer charges to the B3 ledger or to group leaders, etc. This configuration only looks at the current balance due on the reservation. The system does not determine which part of the balance due is room charges vs. other miscellaneous receivables. Therefore, properties that use this feature should collect full payment prior to check-in and have very few receivables on the guest ledger. - Prompt for Long Term Res Departure Date When Processing Revenue

- When checked, owners can be paid for rent posted to long term reservations when running Process Revenue prior to the month-end. When checked, a drop-down is added to the Process Revenue screen and allows selection of Departure Date prior to processing.

- Default Statement Report

- Configure the default name of the Statement Report. Click the Browse button to search through folders to locate the appropriate home for the file. The system default is set to access the RDPNT\RDP\Reports10\Owner folder.

- Default Audit Report

- Configure the default name of the Audit Report. Click the Browse button to search the folders for the appropriate report. When this field is blank, the system uses Owner\OwnerAuditReport.rpt.

- Share Travel Agent & Credit Card Fees with Owners (425-15)

- When checked, the Travel Agent Commission and Credit Card fees are deducted from the Gross Revenue before the Management Fee is calculated. This option also allows up to ten miscellaneous shared expenses to be charged to owners based on a percentage of the revenue.

- Skip Credit Card Fee for Owner Reservations "O-Type" (414-44)

- When checked, the credit card fee is not calculated for the owner.

- Skip Credit Card Fee for Guest of Owner Reservations "G-Type" (414-45)

- When checked, the credit card fee is not calculated for the guest of owner.

- Skip Credit Card Fee for Complimentary (Room Charge is 0.00) Reservations (414-46)

- When checked, the credit card fee is not calculated for the guest.

- Add Ending Statement Marker When Finalizing Statements with No Activity (425-15)

- When checked, a "D@" transaction is created when a statement with no activity is finalized. If it's not checked, the "D@" transaction is not created, and therefore, a "Previous" statement cannot be printed. Only a "New" statement can be printed which shows the "For Review Only" message.

- Bill Owner for Working Balance Deficit

- When checked, the owner's statement shows the amount owed to the property to fulfill the trust account. Example: The trust account is $100 and owner revenue is only $60. If using this feature, the statement shows that the owner owes the property $40 and the $60 is being held in the owner's trust account. If not checked, the statement shows total due owner of $0 and the $60 is held.

- Allow Add But Not Change of Owner E-mail on New Owner Reservation (416-08)

- When making an owner reservation, including timeshare owner

reservations (Res Type T), and the owner already has an e-mail

address, then the e-mail address is displayed on the reservation change

screen and is disabled. If the owner does not have an e-mail

address filed on the owner master record, then the e-mail address can be entered and

the owner master is updated.

When the e-mail address is blank on the owner master, then the e-mail address can be entered on the reservation and the owner master is updated. When an e-mail address exists on the owner master, then the e-mail address is disabled on the reservation -- cannot be changed -- and the owner master is not affected. - Wording for "Working Balance"

- Properties can designate a unique label for this field. Enter any label to replace the "Working Balance" label on the owner master and click Save or "Save & Close". When the Add or Change Owner form is accessed, the "Working Balance" field is labeled as directed (i.e., Trust Account, Working Balance, Trust Funds).

- Display Vacation Rental System (VRS) Configuration Screen

- A link to the VRS Configuration screen has been added to the Statements tab of Owner Configuration.

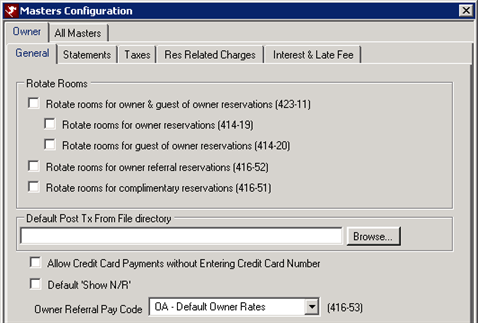

General

- Rotate Rooms for Owner and Guest of Owner Reservations (Switch 423-11)

- When checked, use Owner Rotation to affect Available Rooms for owner reservations as well as guest of owner reservations (Res Types O and G).

- Rotate Rooms for Owner Reservations (Switch 414-19)

- When checked, use Owner Rotation to affect Available Rooms for owner reservations (Res Type O).

- Rotate Rooms for Guest of Owner Reservations (Switch 414-20)

- When checked, use Owner Rotation to affect Available Rooms for guest of owner reservations (Res Type G).

- Rotate Rooms for Owner Referral Reservations (Switch 416-52)

- When checked, use Owner Rotation to affect Available Rooms for owner referral reservations (Res Type R).

- Rotate Rooms for Complimentary Reservations (Switch 416-51)

- When checked, use Owner Rotation to affect Available Rooms for complimentary reservations (Res Type C).

- Default 'Post TX from File' Directory

- Browse (or type directly into the field) to select the default directory searched first when attempting to locate the current days file.

- Allow Credit Card Payments without Entering Credit Card Number

- Allow credit card payments from owners without requiring the clerk to enter the credit card account number, expiration date or authorization number. If no credit card account is specified, the payment is not processed through the Protobase Credit Card Interface and these fields, as well as the credit card company name field (AMEX, VISA, etc.), is left blank on the resulting payment transaction.

- Owner Referral Pay Code (Switch 416-53)

- Set the default pay code for owner referral reservations. When IRM.Net is used and "R" Reservations are used, then this pay code defaults for the IRM.Net R Type Reservations as well.

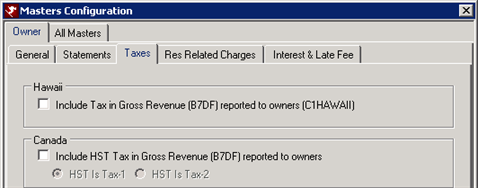

Taxes

State of Hawaii Tax Settings

Taxes are determined and reported to condo owners in the State of Hawaii during the Process Revenue function which uses the Tax-1 and Tax-2 amount fields from the reservation revenue transactions.

- Include Tax in Gross Revenue (B7DF) Reported to Owners (C1HAWAII)

- For properties operating in the State of Hawaii, taxes are added to the owner's gross revenue. Those taxes are the responsibility of the owner and not the property management company. Check this box to divide taxes on the reservation into two taxes: Room tax and Excise tax.

Canada

Certain Canadian Provinces collect GST (Goods and Services Tax), while others collect a HST (Harmonized Sales Tax). Those collecting HST are British Columbia, Ontario, Nova Scotia, New Brunswick, and NewFoundland and Labrador. The RDPWin system refers to either tax as HST.

- Include HST Tax in Gross Revenue (B7DF) Reported to Owners

- When checked, the HST feature for Canadian customers is active and properties can selectively allow the passing the HST on a rental to the owner as well as adding HST on services/charges done by the property management company on the owner’s property on an owner-by-owner basis. The tax information is included in the Canadian Owner Statement and there are two additional fields on the owner master screen: Owner Pays HST and Charge Tax Code.

- HST is Tax 1 or Tax 2

- Select from "HST is Tax-1" (default setting) or "HST is Tax-2" to identify where which tax amount to pass onto the owner when processing revenue.

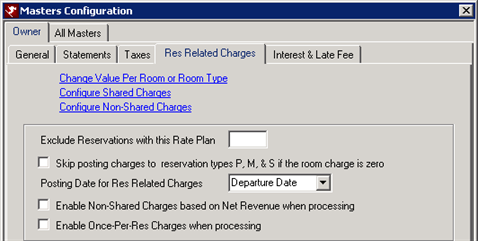

Res Related Charges

- Exclude Reservations with this Rate Plan

- All reservations with the specified rate plan are not used to generate charges to owners.

- Skip Posting Charges to Reservation Types P, M, and S if the Room Charge is Zero

- When selected, reservations that have a zero room charge and a type of "P", "M" or "S" do not generate charges to owners.

- Posting Date for Res Related Charges

- Set the default posting date to be used when posting Res Related Charges. Select Arrival or Departure from the drop-down list.

- Enable Non-Shared Charges Based on Net Revenue When Processing

- When checked, the Use on Net Rev column is available on the Non-Shared Charges Configuration screen.

- Enable Once-Per-Res Charges When Processing

- Owner Revenue processes individual revenue transactions and is designed to calculate charges based on each transaction. When checked, the shared charges to be calculated only once for the reservation when processing a transaction with a date equal to the arrival date is allowed.

Change Value Per Room or Room Type

Click the link to open the Reservation Related Owner Charges screen

for maintenance. Click Display to produce a list of transaction

codes set for room types and room numbers. The "No Filter "

boxes are checked by default. Uncheck and select a transaction,

room type, or room number from the drop-down lists to narrow the display.

Select NOPOST in the Room Type field to allow specified room numbers to

be excluded from a configured charge. For instance, if a Hot Tub

Fee is set up to post to all 1B rooms or even all owners with reservation

activity, then when any room numbers with NOPOST in the room type are

found, that charge is skipped for that owner. This permits exceptions

based on different contracts among the management company and the owners

(or for other reasons).

Once displayed in the grid, hover over a cell within the grid to display

the drop-down arrow to maintain codes, room and reservation types, room

numbers, and amounts individually.

- Add Owner Charge

- Click to add a new row to the grid and add additional owner charge details. For example, is the charge different for specific room types? Set the amount for each charge entry. In the example above, hot tub fees are configured based on room type: $15 for 1B rooms, $20 for 1BL rooms, $25 for 2B rooms, etc. In the case of Room 111, there is no charge for Room 111 regardless of room type.

Configure Shared Charges

Click the link to open the Owner Expense Configuration screen and maintain

Table OS. Items in the grid are specifically configured for expense

shared between the property and the owner such as common area landscaping.

Charge information can be added or changed. Click Add

Expense to add a row to the grid and enter additional owner charge details

that are shared.

- Use Flat Amount

- Charge owners a flat, shared expense when processing owner revenue. These are shared charges applied BEFORE calculating the management fee, so the charge is shared between the owner and the management company.

To use this feature for a new charge, check both the "In Use" and "Use Flat Amt" checkboxes in the "Shared Charges Configuration" grid, and enter an amount in the "%Rate/Amt" field. Check to this box to post the charge nightly. When not checked, the charge is posted only once per reservation. To have a unique amount for each room type or room number, check the "Use Owner Tx" checkbox, and then configure "Change Value per Room or Room Type" option on the Res Related Charges configuration tab.- Calc Once Per Night Only

- Check this box to calculate the shared charge once per night only. When not checked, the charge may be calculated multiple times per night – one for each owner revenue transaction found for each night of the reservation.

- Use Owner TX

- To have a unique amount for each room type or room number, check the "Use Owner Tx" checkbox, and then configure "Change Value per Room or Room Type" option on the Res Related Charges configuration tab.

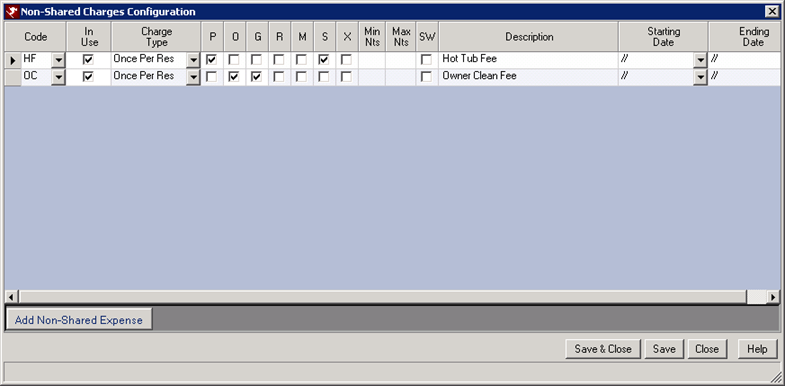

Configure Non-Shared Charges

Click the link to open the Owner Expenses Configuration screen and maintain

Table OT. Charge information can be added or changed. Click

Add Expense to add a row to the grid and

enter additional owner charge details that are not shared such as hot

tub (drain/clean/refill) and cleaning fees.

- Use on Net Rev Column

- Available only Enable Non-Shared

Charges Based on Net Revenue When Processing, when "When checked, the

system considers the charge when processing owner revenue instead of

res-related charges. This allows a charge to be added to the owner based on a percentage of the net revenue. The net revenue is calculated as the gross revenue less the shared travel agent and credit card fees.

Checking this box disables many other columns in the selected row, since those columns are not relevant when using the charge in Process Revenue.

- Charge Type | Percentage - Room Rev.

- A new charge type has been added to calculate a charge to an owner using Res Related Charges based on Room Revenue as opposed to Percentage - Gross Rev (Room + Other Revenue).

- Reservation Type

- The non-shared charge can be post to the owner for certain reservation types. For example, the owner cleaning fee is charged for owner and guest of owner reservations. Check the appropriate reservation types.

- P = Paying guest reservations

- O = Owner reservations

- G = Guest of owner reservations

- R = Owner referral reservations

- M = Multiple folio reservations (group leader reservations)

- S = Special reservations

- X = Maintenance reservations

- Min Nights

- The minimum nights field on the non-shared charges looks at the number of nights of the reservation in the month that is being processed. It is not a minimum nights of the reservation. It looks the number of nights within the month, whether it is 28, 30, or 31 nights.

- Max Nights

- The maximum nights field on the non-shared charges looks at the number of nights of the reservation in the month that is being processed. It is not a maximum nights of the reservation. It looks the number of nights within the month, whether it is 28, 30, or 31 nights.

- SW Column

- Allow for more flexibility when calculating charges on sharewiths. When checked, the charge is posted to non-primary sharewith reservations (in addition to primary sharewith and all non-sharewith reservations). When not checked, the charge is posted to the primary sharewith and all non-sharewith reservations only. Properties can charge the owner a fee based on all reservations in an unit with a room charge including sharewith reservations.

- Starting Date

- If the non-shared charge should start on a specific date, enter the date in this field. If the field is blank, the charge is effective once the Res Related Charges are processed.

- Ending Date

- If the non-shared charge should end on a specific date, enter the date in this field. If the field is blank, the charge will continue to post when the Res Related Charges are processed.

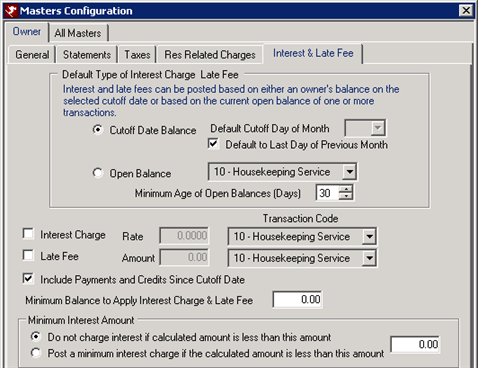

Interest & Late Fee Tab

- Cutoff Date Balance

- Select Cutoff Date Balance to post interest and late fees based on an owner's balance on a selected cutoff date. When selected, the "Default Cutoff Day of Month" drop-down and "Default to Last Day of Previous Month" checkbox are enabled.

-

- Default Cutoff Day of Month

- When Cutoff Date Balance is selected, choose a date to serve as the default cutoff day each month. If "Default to Last Day of Previous Month" is checked, this field is disabled. Numbers available are 1-28 (since 28 is the highest date common in all months).

- Default to Last Day of Previous Month

- When Cutoff Date Balance is selected, check this box to set the default cutoff day to be the last day of the previous month.

- Open Balance

- Select Open Balance to post interest and late fees based on the current open balance of one or more transactions. Select transaction type from the drop-down list.

- Interest Charge

- Check to post a percentage of the balance due by default. Enter the default percentage rate into the Rate field. Enter 2.25 percent as "2.25", not ".0225". This amount is charged to the total of all open items that are older than the transaction cut-off date entered.

- Late Fee

- Check to post a flat dollar amount to any owner that has at least one open transaction older than the cut-off date input as the default. Enter the default amount.

- Include payments and Credits Since Cutoff Date

- When checked, the system calculates the late fee based on the balance due including any payments received since the cutoff date. When unchecked, late fees are calculated without regard to payments received.

- Minimum Balance to Apply Interest Charge & Late Fee

- When set to other than 0.00, the system applies the amount entered here when the Interest Charge & Late Fee is less than the amount entered here. For example, when the calculate amount of Interest and Late Fee to be charged is $10, and the amount entered here (Min. Bal. to Apply...), is $20, then the amount posted to the owner is $20.

- Do Not Charge Interest if Calculated Amount is Less than This Amount

- Post a Minimum Interest Charge if the Calculated Amount is Less Than This Amount

- Select this radio button to post a minimum interest amount when compared

to the amount entered in the text box.

Example: Interest Rate is set to 5%. When $20 is entered in the text box, the “Post a Min. Int. Charge…” radio button is selected, and an owner has an outstanding balance of 100.00, the owner will be charged $20.00 instead of $5.00.

Save & Close, Save, Reset, and Close

Click here for instruction on how to Save, Reset, and Close forms.

Click these links for Frequently Asked Questions or Troubleshooting assistance.