Overview

This feature is specifically designed for Squaw Valley Lodge. For information, please contact RDP Sales.

A configurable percentage of an owner's credit balance is transferable to the secondary owner's account to hold funds in a reserve for capital improvements of the property. A specified percentage can be configured to transfer when owner statements are finalized.

An optional maximum may be set so that no more than the configured maximum is held in reserve, as well as an optional configured minimum so the owner must maintain this amount.

To Implement Working Capital Transfer

Add the following four records to the C1 Table: WCBAL, WCBAL1, WCBAL2, WCBAL3, WCBAL4 as described below.

- WCBAL: Add this record to the C1 Table with a 'Y' in the Data field. This turns on the feature.

- WCBAL1: This is the percentage rate used to calculate the transfer amount. For example, 3% is entered as 3.00. This setting is required in order for the feature to work.

- WCBAL2:Define the two B7 Ledger transaction codes here. The transaction code used to post the transfer from the primary owner is the first transaction code, followed by the transaction code used to post the credit to the working capital owner account. For example, transaction code WC is the working capital transaction code. Enter 'WCWC' in the Data field. Both sides of the transfer will use code WC. This is a required setting. Both transaction codes must be defined, but they can be the same code.

- WCBAL3: This is the maximum working balance amount. For example, if the maximum is $4500, enter 4500.00. This setting is optional.

- WCBAL4: This the mimimum balance the primary owner must have in order to transfer a percentage to the working capital account. This setting is optional. No minimum is required, or a minimum amount of 0.00 can be entered.

If the corresponding working capital owner account does not exist for an owner, then the transfer will not occur.

Transfer Working Capital Funds

- Process owner revenue before running the Transfer Working Capital Funds. For more information on this procedure, see Process Owner Revenue.

- Go to the Owner main menu --> Month End --> Transfer Working Capital Funds.

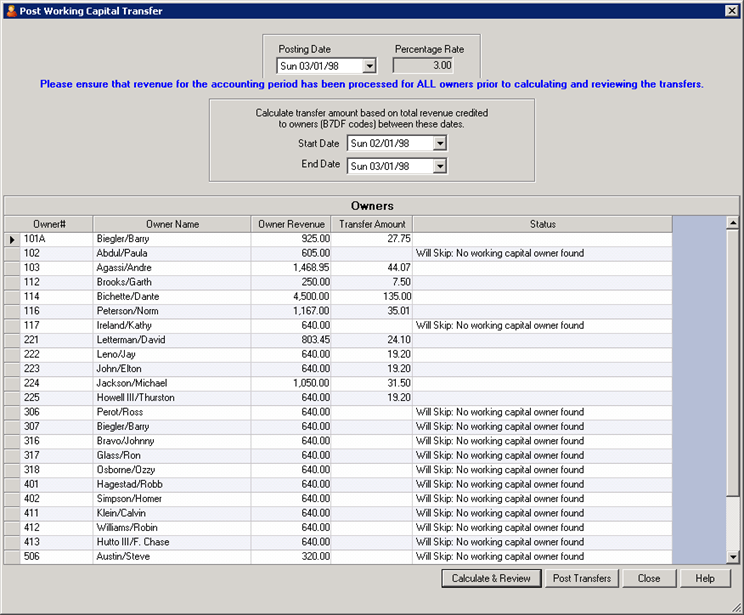

- Select the Posting Date. This date is generally the end of the month or statement period.

- Verify the Percentage Rate field is correct.

- Select the Start Date and End Date. This is generally the month or statement period. All the B7DF transactions from this date range will be totaled and the transfer amount, along with the percentage rate will be based on this total.

- Click the Calculate and Review button.

- Verify the amounts are correct.

- Click Post Transfers.

Click these links for Frequently Asked Questions or Troubleshooting assistance.

11/3/2011