Click here for tutorials.

Overview

During the setup of systems at installation, reservation and account balances from the old system must match the new system balances. Below are some helpful steps to achieve this.

- All real reservation must be in, including any that are checking out on or after the go live date.

- Take deposits as miscellaneous payments.

- Any deposits being held for future reservations with no arrival date (held deposits) have a room type set to "Held".

All amounts in Items 1, 2, and 3 equal the total amount in the B1 ledger. See below for Balancing Accounts and Trust Accounting detail.

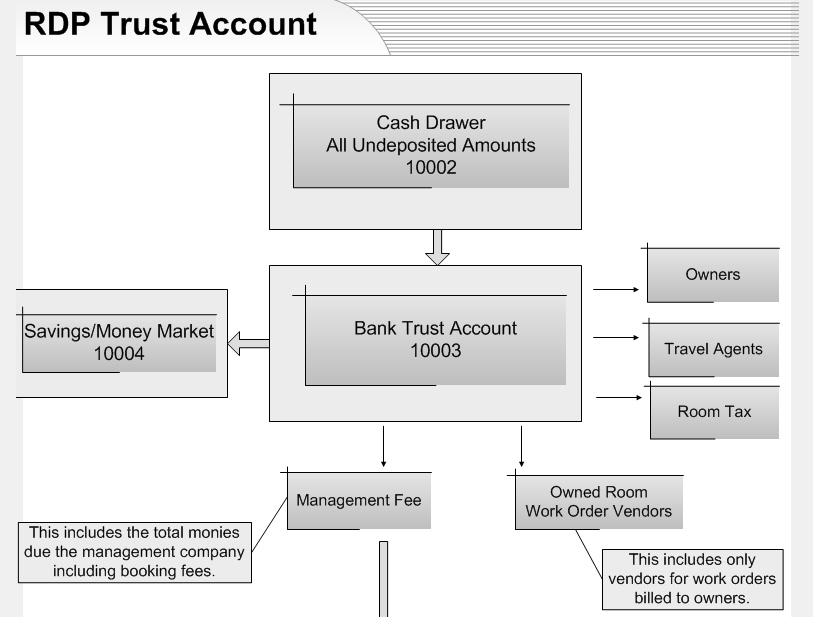

Trust Accounting

All payment codes go to (asset or liability) Account 10002 which consists of payments yet to be deposited. This must balance to the advanced or otherwise payments deposited from the old system. Once balanced, manually adjust 10002 and divide it into the appropriate accounts based on where it is in their old account (checking, savings, money/market accounts, etc.).

Typical "Check-in, Totals Not Reset" customers have two accounts:

10003 checking and 10004 savings/money market. Customers may currently

owe outside vendors. Use the B3 ledger to move money around. Post B3BB

code to post negative numbers to those owned which will go to Account

10003. Customers may have borrowed from the advanced deposit account.

A charge should be posted to management for the money owed with a special

code. As payments from management are paid back to that account, the total

updates.

Accounts 10002 and 10004 together should equal the Trust Account 10003

balance. The flow chart below shows how money moves through the accounts

using a trust accounting system.

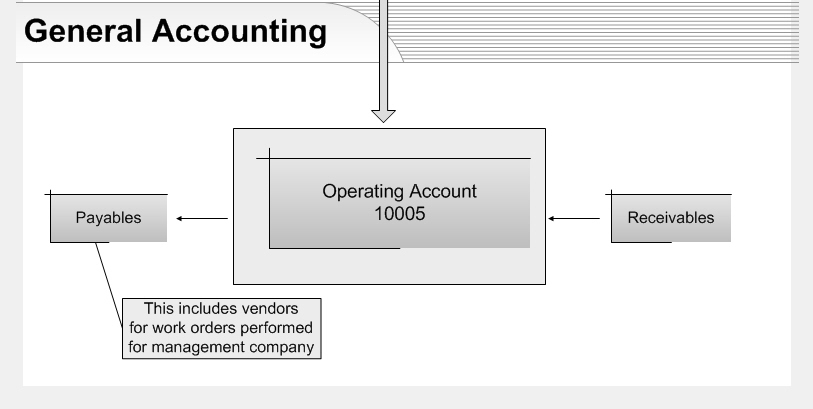

Work Order Vendors can be paid from either Account 10003 or 10005 depending on the situation. Work Orders billed to owners such as a plumbing service call is paid from the Trust Account 10003. The work is performed, an invoice sent to the management company which is billed to the owner, the management company receives payment from the owner and deposits it into Account 10003, and then pays the vendor from Account 10003. However, when the management company's corporate office opens a work order for a plumbing service, that invoice is paid from Account 10005. The work is performed, an invoice sent to the management company, and then pays the vendor from Account 10005.

Balancing Accounts

For customers using trust accounts, RDP must balance to zero at the

end of every month. If not, management is responsible for the outstanding

amount and must make a deposit into RDP to balance the system to zero.

The sum of the 10002 (deposits not recorded) + 10003 (checking account)

+ 10004 (money market account-optional) must match what is truly in the

trust bank accounts. At the end of the month, checks are cut to

all owners, vendors, travel agents, the management company, and the advanced

deposits (which represents the paying guests money being held) are backed

out. The trust (RDP) must balance to zero.

To better understand this type of accounting, think of RDP as a ”money

redistributing entity” that is independent of all other entities

involved and never makes a dime for itself. The trust (RDP) redistributes

all funds taken in and makes sure no credits or debits are left in any

accounts receivable at the end of the month. Every time a charge or payment

is assigned to an owner, guest, or vendor, it's necessary to know how

that particular posting affects the trust and who receives the ”check”

at the end of the month for that posting.

For example, a management company runs a carpet cleaning business and often

posts carpet cleaning charges to owners. Every time a charge is

posted to an owner, an opposite charge must be posted to the vendor master

(carpet cleaning) in the B3 ledger. The trust (RDP) cuts the vendor

a check or creates a voucher for Carpet Cleaning. Management would

then take the check and deposit it into a bank account not associated

with RDP such as 10005 so RDP balances to zero.

Customers can use the B3 ledger to manage their trust account. After the

accountant balances what is in 10002 to a source outside of RDP (checks,

credit card payments, actual cash), a bank deposit can be made and then

a transfer of funds to 10004 in RDP so it matches the outside trust checking

account. This requires a groups master (i.e., Trust) and two transaction

codes so the accountant can transfer funds between the two accounts. Funds

can also be transferred from 10004 to the 10003 at the end of the month

for the purpose of cutting checks.

Click these links for Frequently Asked Questions or Troubleshooting assistance.

04/05/2010

© 1983-2009 Resort Data Processing, Inc. All rights reserved.