Click here for How To

Click here for Owner Navigation

- Pooled Owner Accounting Module T3 and Condominium Owner Account Module R3 required.

| Pooled Owner Accounting Topics | |

|---|---|

Overview

Pooled Owner Accounting takes room revenue that is to be paid to owners, pools it together, and splits it among owners based on the room or room type of each owner. Room rental revenue, credit card fees, and travel agents commission fees are pooled among owners of the same room type.

All owners within a room type that had paying guest reservations get included in the pooled revenue. All room charges transactions are summed and divided by the number of rental nights. This establishes the average daily rate. Each owner is then paid this for the reservations in their unit. This amount is may be higher or lower than the actual rent for the reservation in their unit.

Travel agent and credit card fees are pooled. All owners with reservations, regardless of whether the reservations had travel agent or credit cards, will be charged those fees. The total of each of the fees is added and divided by the number of rental nights. Each owner is charged for how many rental nights they had in their unit.

The following reservation types are never pooled: O-Owner, G-Guest of Owner, X-Maintenance, T-Timeshare Owner, Q-Timeshare Owner Inventory, B-Bonus Time, E-Exchange, and R-Owner Referral.

- Extra Person Premiums

- Extra Person Premiums are charged for reservations that exceed the base number of people in a room. The reservation is charged a fee per night for each adult (People 1) that is over the base people for the room type. This extra person charge is built into the room charge portion and must be subtracted from the room revenue and reported separately. Extra person premiums are pooled and reported on the statements as a separate line item.

- When the rate is discounted, the extra person premium is discounted as well. For example, if the extra person premium is $12 and the discount rate is 15%, the extra person premium becomes $10.20. This is subtracted from the gross nightly room rate to calculate the room revenue. A new system code on the owner ledger, B7SF - Extra Person Premium, is used to post the extra person premium to the owner for each reservation.

- Short Stay Premiums

- Short Stay Premiums are charged for reservations less than 7 nights. The reservation is charged a surcharge each night for the stay. The short stay premium amount must be built into the rate set. The system will subtract this from the room revenue and report it separately. This is then pooled and reported on owner statements as a separate line item.

- When the rate is discounted, the short stay premium is discounted as well. For example, if the short stay premium is $25 and the discount rate is 15%, the short stay premium becomes $21.25. The system will subtract this from the gross nightly room rate (along with the extra person premium) to a calculate the room revenue. A new system code on the owner ledger, B7SG - Short Stay Premium, is used to post the amount to the owner for each reservation.

How to Configure Pooled Owner Accounting

- Install the T3 Module.

- Configure rate sets to include the Short Stay Premium amount. This rate set should include the extra surcharge for reservations staying less than 7 nights. For information about rate sets, see How to Add Rate Set.

- From the System menu --> Switches --> set switch 427-17: Show Extra Person Premium as Separate Item on Owner's Statement to Yes.

- Set switch 427-18: Show Short Stay Premium as Separate Item on Owner's Statement to Yes.

- Set switch 427-19: Show Cleaning Fee Reimbursement as Separate Item on Owner's Statement to Yes.

- Enter the amount of the Short Stay Premium in switch 427-20: Short Stay Premium Fee.

- Enter the transaction code used to post the cleaning fee to the guest for switch 427-21: Folio Transaction Code Used to Post Clean Fee to Guest.

- Enter the rate sets that are used on the rate plans to include the Start Stay Premium charge to the guest for switch C1CRHSS. If the rate plan on the transaction does not contain one of the rate sets defined here, the Short Stay Premium will not be calculated. Note: This must the Rate Set, not the plan.

- If there are any property codes that should be excluded from the Pooled Owner Accounting, enter the property codes in the C1NOPOOL record. Separate each by a comma.

- If there are any property codes that should be excluded from the Extra Person Premium, enter the property codes in the C1NOEXPR record. Separate each by a comma.

- If there are any property codes that should be excluded from the Short Stay Premium, enter the property codes in the C1NOSSTY record. Separate each by a comma.

Reservation Changes

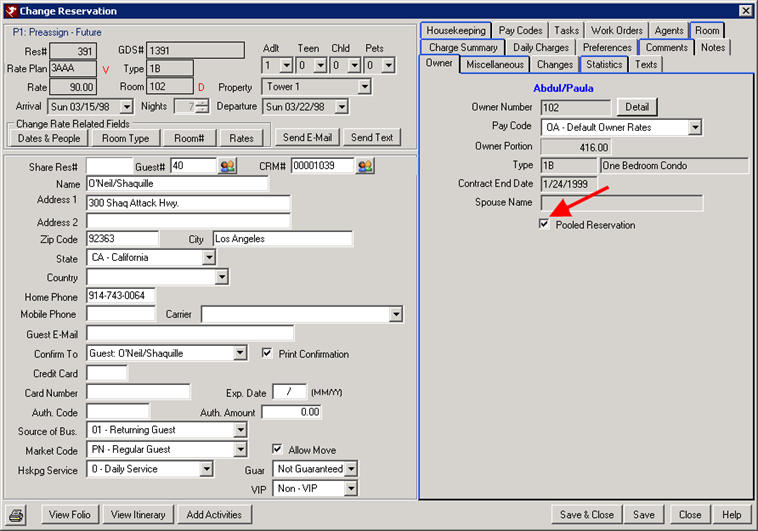

Reservations can be pooled or not by checking the Pooled Reservation box on the Owner tab of the Reservation. Once the T3 Module is installed all new reservations made are pooled by default unless one of the reservation types mentioned above.

Cleaning Fee Reimbursement

To enable cleaning fee reimbursement, set switch 427-19 to Yes and enter the reservation transaction code for the cleaning fee in switch 427-21. See steps 5 and 7 in the Configuration section of this document for details.

The housekeeping fee is charged to the owner in order to pay the cleaning company for reservation in that owner's unit. When the housekeeping fee is posted, and the housekeeping transaction code exists on the guest folio, the Res Related Charges also posts a negative of the charge as a reimbursement to the owner. A new system code, B7SH-Cleaning Reimburse, is used to post the cleaning reimbursement to the owner.

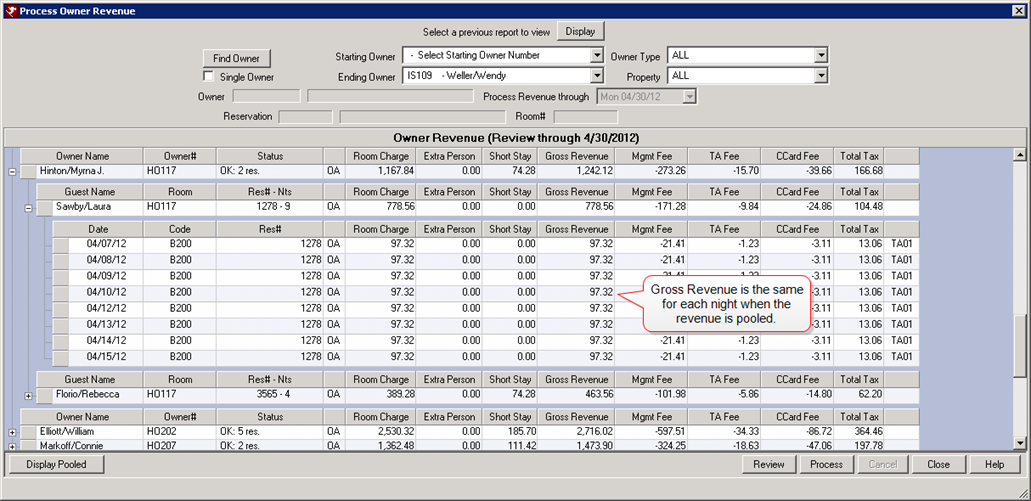

Process Revenue

The Process Revenue program calculates the total room revenue for each room type. Then it divides that by the number of rental nights to get the average nightly rate. Each owner that had rental activity is paid the average nightly rate for each rental night they had in their unit. For example, one bedroom units had a total of $1000 of rental revenue for the month. There were a total of 10 rental nights between all owners of one bedrooms. The average rate would be $100. If an owner had a reservation for 3 nights, they would be paid $300.

ADR = Total Room Charge / Total Number of Nights

$3382.86 / 26 Nights = $130.11 ADR

Process Revenue all pools the travel agent and credit card fees and splits them among owners that had rental activity.

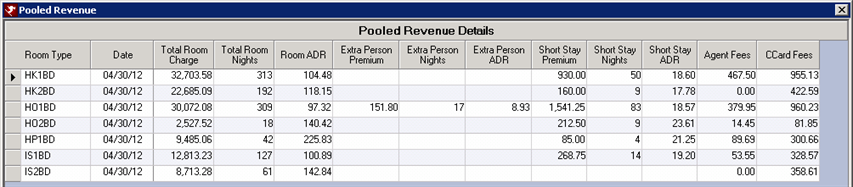

- Display Pooled

- Click the Display Pooled button at the bottom of the Process Revenue screen to view the totals and how the numbers are calculated. The grid is grouped by the room type.

-

- Short Stay Premiums

- Short Stay Premiums are charged for reservations less than 7 nights. The reservation is charged a surcharge each night for the stay. The short stay premium amount must be built into the rate set. The system will subtract this from the room revenue and report it separately. This is then pooled and reported on owner statements as a separate line item.

- When the rate is discounted, the short stay premium is discounted as well. For example, if the short stay premium is $25 and the discount rate is 15%, the short stay premium becomes $21.25. The system will subtract this from the gross nightly room rate (along with the extra person premium) to a calculate the room revenue. A new system code on the owner ledger, B7SG - Short Stay Premium, is used to post the amount to the owner for each reservation.

- Only owners that had reservations in their unit with the Short Stay Premium receive revenue for this. The total of the Short Stay Premium is added per room type and divided by the number of rental nights. This establishes the ADR for the Short Stay Premium. Each owner with reservations with the Short Stay Premium receive this revenue, which is calculated based on the number of rental nights and the ADR of this charge.

- Include Forfeit Revenue in Pooled Amount - Switch 427-25

- Set switch 427-25 (Include B2SF - Forfeit in Pooled Revenue) to Yes. This will include forfeited revenue transactions in the pooled revenue amounts in order to be disbursed among owners. When a reservation is cancelled and the deposit is forfeited, this generates a B2SF transaction code for the forfeit amount. This amount is then included in the pooled revenue.

Pooled Owner Accounting - Include COMP Nights in Pooled Amount

The Fifth Night Free feature allows rate plans that have been configured to give the guest their fifth night to still pay the owner the revenue for the free night in a pooled owner accounting configuration. To enable this feature, go to the System menu --> Switches --> locate switch C1PLCOMP. Enter the rate plans that have the free night, separating each rate plan with a comma. When processing pooled revenue, the system will look for these rates listed in the C1PLCOMP record that have a COMP rate included, and the owner will be paid for the free night using the ADR pooled amount for the month.

Travel Agent Commissions

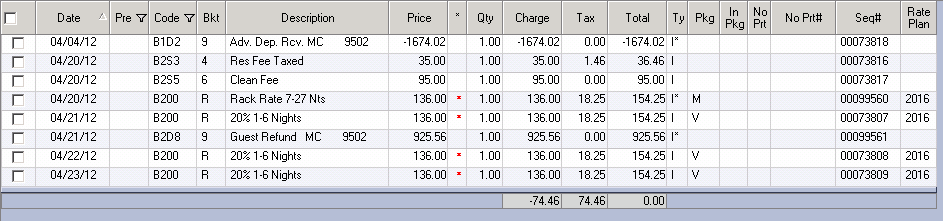

Information below displays how the travel agent commissions are calculated and pooled. Only owners that had reservations with travel agents are included in the travel agent commission pooling.

| Reservation #1 |

|---|

|

|

$144.50 Nightly Rate x 15% Travel Agent Commission = $21.675 $21.675 x 4 Nights in the month of April = $86.70 |

| Reservation #2 |

|---|

|

|

$136.00 Nightly Rate x 15% Travel Agent Commission = $20.40 $20.40 x 4 Nights in the month of April = $81.60 |

Total Commissions = $86.70 + $81.60 = $168.30

Total Commission Rate = $168.30 / $3382.86 Gross Revenue = 0.0498

Travel Agent Fee is calculated per night by taking the Gross Revenue x the Total Commission Rate

Example: $136 x 0.0498 = $6.77

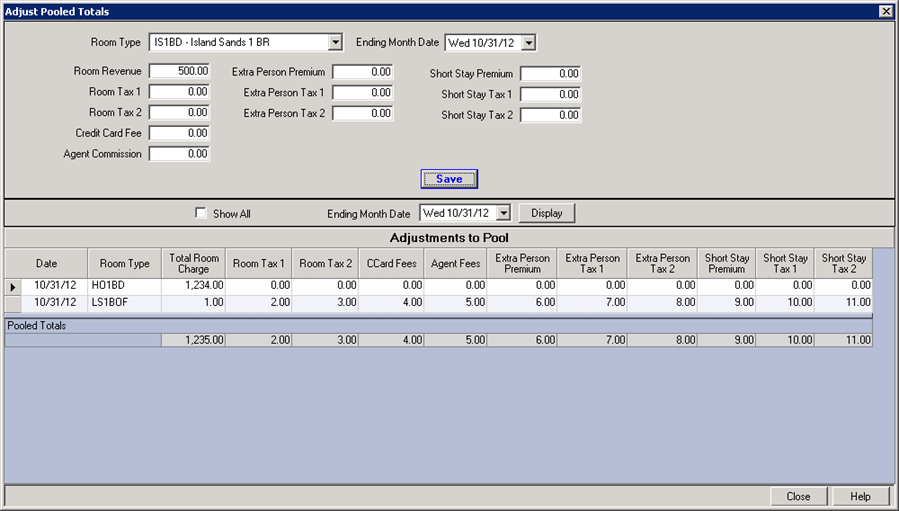

Adjust Pooled Revenue

Revenue, taxes, extra person premiums, and fees can be adjusted for the pooled owner revenue. Enter the adjustment amounts, and when revenue is processed, the adjustment is added to the original amount in order to get the pooled revenue figure.

- Room Type

- Since pooled revenue amounts are calculated by room type, select the room type to adjust from the drop down.

- Ending Month Date

- Select the date for which to make the adjustment. Only the last day of the prior month is allowed. Previous months that have been already been processed and statements finalized cannot be adjusted.

- Room Revenue

- Enter the amount of the pooled room revenue adjustment. This amount will be added to the Pooled Owner Revenue amount when the Process Revenue program is run. For example, if the pooled revenue amount is $5000, but the amount should be $5500, enter $500 in the Room Revenue field. Process Revenue will add the original amount of pooled room revenue plus the adjustment. Negative adjustment amounts can be entered.

- Room Tax 1, Room Tax 2, Credit Card Fee, and Agent Commission

- Enter the amount of the adjustment for these fees. When Process Revenue is run, these adjustments will be added to the original amounts.

- Extra Person Premium, Extra Person Tax 1, and Extra Person Tax 2

- Enter the amount of the adjustment for the extra person premiums and any applicable tax. When Process Revenue is run, these adjustments will be added to the original amounts.

- Short Stay Premium, Short Stay Tax 1, and Short Stay Tax 2

- Enter the amount of the adjustment for the short stay premiums and any applicable tax. When Process Revenue is run, these adjustments will be added to the original amounts.

- Save

- Click the Save button to save the adjustments.

- Month Ending

- Select the last day of the statement month for which to view the revenue amounts. All room types will revenue will appear in the grid.

- Display

- Click the display button once the last day of the statement month is selected in order to view the revenue amounts by room type in the grid.

Click these links for Frequently Asked Questions or Troubleshooting assistance.

11/19/2012

© 1983-2012 Resort Data Processing Inc. All rights reserved.